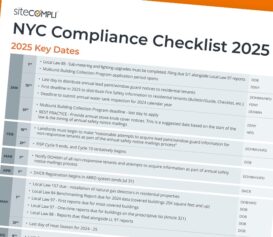

May 1, 2025 has been looming on the compliance calendar of every NYC owner and manager for a long time. Now that it’s here, we wanted to give you a quick guide to making sure your portfolio is covered continuing into 2025 and beyond.

Some requirements like Local Law 97 already have a built-in grace period; filings can be submitted without penalty through June 30, 2025. And as of April 21st, the DOB announced that they’re extending this year’s Local Law 84 deadline through June 30th, as well. You can view their latest Service Notice for more details.

JUST ANNOUNCED 6/16: The extension date is now through the end of the year (December 31, 2025). See the DOB’s latest Notice, and make sure you apply for an extension by August 29th!

Here are quick reminders and action items for each requirement (if you want the full rundown, check out this year’s updated Big Book of NYC Compliance):

Local Law 157

Local Law 157 requires owners and managers to install one or more natural gas detectors (depending on the presence of gas appliances in the unit). There are specifics outlined in the law regarding device location, and line-operated zoned alarms for Class B multiple dwellings. You must also provide notices to residents informing them of this requirement, and post the same in a common space.

While the DOB has provided FAQs here, HPD will ultimately be responsible for enforcement. We’re assuming enforcement will be similar to complaint-based inspections for smoke and carbon monoxide detectors, especially since requirements for providing notices to residents are similar.

There are a number of approved devices teams can install. We shared information on popular device options from the experts at F&F Supply, and you can learn more about other options available (like smart devices) from teams like ProSentry.

As of mid-April, HPD has not announced any grace periods or deadline extensions. We’re waiting on updated notice language from the Department, and will link that here as soon as it’s available.

Confirm that natural gas detectors are installed as required in applicable dwelling units, and proof is recorded and on file.

InCheck users can confirm installation using inspections, mobile-app captured photos, Compliance Manager tasks and more. Reach out to your Customer Success Manager for best practices, or to get started.

Sustainability Requirements

Local Law 84

Local Law 84 requirements for filing annual benchmarking data continue as they have over the past several years. NEW – as of 4/21/25, the DOB has announced an extended filing deadline of June 30th, 2025 – to coincide with the Local Law 97 deadline extension.

If teams need even more time to file, they can view the latest service notice for details on requesting an extension through August 29th.

Fines are the same as past cycles, with a $500 fee assessed for failure to comply by each quarterly deadline within the filing year:

- May 1st, 2025 (now June 30th, 2025)

- August 1st, 2025

- November 1st, 2025

- February 1st, 2026

Failing to file by the above dates can culminate in $2,000 worth of fines for a single cycle.

Local Law 97

This is the big one. It’s the first time many owners and managers will have to submit filings on their building emissions. Teams have until June 30th (grace period deadline) to submit, but can also request an extension before that date, giving you until August 29th to comply.

Properties on the Standard covered building list will file their first annual report, while properties on the Prescriptive list (Article 321 buildings) will file a one-time report (for now).

Given the uniqueness of the law, there’s two areas of risk – failure to file, and failure to meet limits/comply:

- Failure to file report

- Article 321 buildings: $10,ooo for failure to file on time

- Standard buildings: building floor area x $0.50/month

- Failure to comply

- Exceeding emission limits for standard buildings: (Actual emissions – emissions limit) x $268/year

- Failing to demonstrate compliance with one of two pathways for Article 321 buildings: $10,000

The DOB has an extensive resource page on Local Law 97, linked here.

There are also key resources for process steps and penalty mitigation:

Confirm which covered building list your property is on, and make sure your report is on file before June 30th. Reports can be filed via the BEAM portal, and you can get a step-by-step guide for the process here.

Access covered building information for your portfolio directly in your SiteCompli account, here.

Local Law 88

Local Law 88 requires covered buildings (minus exceptions) to upgrade lighting power allowances and controls, and install electrical sub-meters in covered tenant spaces. It’s a one-time filing requirement, unlike Local Law 97 (for buildings outside of the Prescriptive List).

Per the Department’s FAQs, Local Law 88 information can be filed alongside Local Law 97 data in the BEAM portal. If an owner is subject to both LL 88 and LL 97 this year, fees are combined (along with the grace period and extension opportunities). If an owner is required to submit Local Law 88, but not Local Law 97 this year, due dates and grace periods remain the same (May 1st to June 30th), but there will be no extension opportunity.

A good overview presentation from the DOB outlining process and FAQs is linked here.

If your property is required to comply, make sure your report is on file before the deadline. Reports and Attestations can be filed via the BEAM portal, and you can get a step-by-step guide for the process here.

If you have questions about Local Law 88 requirements for your property, reach out to your Customer Success Manager or support@sitecompli.com. We’re happy to send a covered buildings report for your portfolio.

As always, our team is on standby to help answer any questions you have about compliance for your building, or how you can use features in your SiteCompli & InCheck accounts to log and track your actions here.